san francisco county sales tax rate

The California state sales tax rate is currently. This is the total of state county and city sales tax rates.

Understanding California S Sales Tax

The tax is collected by hotel operators and short-term rental hostssites and remitted to the City.

. In light of the COVID-19 public health crisis and shelter-in-place orders in effect in San Francisco the sale scheduled for May 1 2020 through May 4 2020 has been cancelled. The California sales tax rate is currently. The 85 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 225 Special tax.

This rate includes any state county city and local sales taxes. 2020 rates included for use while preparing your income tax deduction. South San Francisco CA is in San Mateo County.

The South San Francisco California sales tax is 750 the same as the California state sales tax. 750 Is this data incorrect Download all California sales tax rates by zip code. What is the sales tax rate in San Francisco California.

2021 List of Louisiana Local Sales Tax Rates. The current total local. San Francisco is in the following zip codes.

There is no applicable city tax. The total sales tax rate in any given location can be broken down into state county city and special district rates. San Francisco imposes a 14 transient occupancy tax on the rental of accommodations for stays of less than 30 days.

Re-Offer of Timeshare Properties Auctioned. This is the total of state county and city sales tax rates. 2020 rates included for use while preparing your income tax deduction.

The latest sales tax rate for South San Francisco CA. List of Timeshare Properties Auctioned. Ad Find Out Sales Tax Rates For Free.

Did South Dakota v. This is the total of state and county sales tax rates. Louisiana has state sales tax of 445 and allows local governments to collect a local option sales tax of up to 7.

To review the rules in California visit our. South San Francisco is in the following zip codes. The transient occupancy tax is also known as the hotel tax.

The minimum combined 2022 sales tax rate for San Francisco California is. The California sales tax rate is currently 6. CA is in San Francisco County.

California City and County Sales and Use Tax Rates Rates Effective 10012018 through 03312019 City Rate County Acampo 7750 San Joaquin Acton 9500 Los Angeles Adelaida 7250 San Luis Obispo Adelanto 7750 San Bernardino Adin 7250 Modoc Agoura 9500 Los Angeles Agoura Hills 9500 Los Angeles. The San Francisco sales tax rate is. Fast Easy Tax Solutions.

The latest sales tax rate for San Francisco CA. Puerto Rico has a 105 sales tax and San Francisco County collects an additional 025 so the minimum sales tax rate in San Francisco County is 625 not including any city or special district taxes. Register for a Permit License or Account.

The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375 Special tax. What is the sales tax in San Francisco 2020. The minimum combined sales tax rate for San Francisco California is 85.

San Francisco has parts of it located within San Mateo County. The December 2020 total local sales tax rate was 8500. The 2018 United States Supreme Court decision in South Dakota v.

The California sales tax rate is currently 6. 0875 lower than the maximum sales tax in CA. The San Francisco County sales tax rate is.

List of Non-Timeshare Properties Auctioned. 2019 Public Auction. The San Mateo County sales tax rate is.

Presidio of Monterey Monterey 9250. This rate includes any state county city and local sales taxes. This table shows the.

You can find more tax rates and allowances for San Francisco County and California in the 2022 California Tax Tables. The County sales tax rate is 025. This is the total of state county and city sales tax rates.

While many other states allow counties and other localities to collect a local option sales tax California does not permit local sales taxes to be collected. The County sales tax rate is 025. The sales tax jurisdiction name is San Francisco Tourism Improvement District which may refer to a local government.

California has a 6 sales tax and San Francisco County collects an additional 025 so the minimum sales tax rate in San Francisco County is 625 not including any city or special district taxes. The California state sales tax rate is currently. The County sales tax rate is.

San Francisco County Sales Tax Rates for 2022. Within San Francisco there are around 39 zip codes with the most populous zip code being 94112. Identify a Letter or Notice.

San Francisco County in California has a tax rate of 85 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in San Francisco County totaling 1. What is La tax rate. The San Francisco County sales tax rate is.

There are a total of 181 local tax jurisdictions across the state collecting an average local tax of 4712. This is the total of state and county sales tax rates. California City County Sales Use Tax Rates effective April 1 2022.

The average cumulative sales tax rate in San Francisco California is 864. The 2018 United States Supreme Court decision in. File Monthly Transient Occupancy Tax Return.

The total sales tax rate in any given location can be broken down into state county city and special district rates. The current total local sales tax rate in San Francisco County CA is 8625. The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a 025 county sales tax and a 225 special district sales tax used to fund transportation districts local attractions etc.

Has impacted many state nexus laws and sales tax collection requirements. 1788 rows Find Your Tax Rate. The minimum combined 2022 sales tax rate for San Francisco County California is.

This includes the rates on the state county city and special levels.

California Sales Tax Small Business Guide Truic

California Sales Tax Guide For Businesses

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

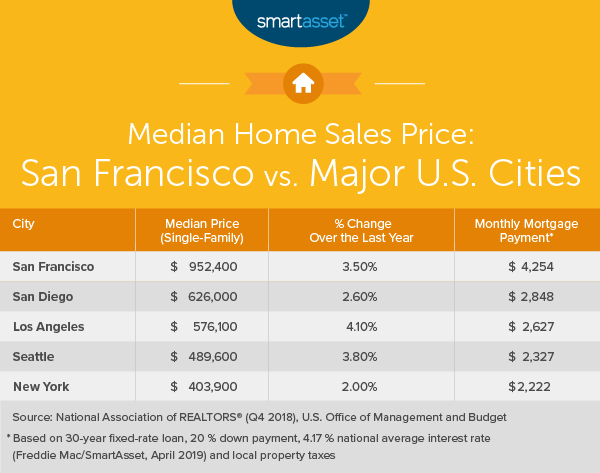

What Is The True Cost Of Living In San Francisco Smartasset

Sales Gas Taxes Increasing In The Bay Area And California

Map State Sales Taxes And Clothing Exemptions Trip Planning Map Sales Tax

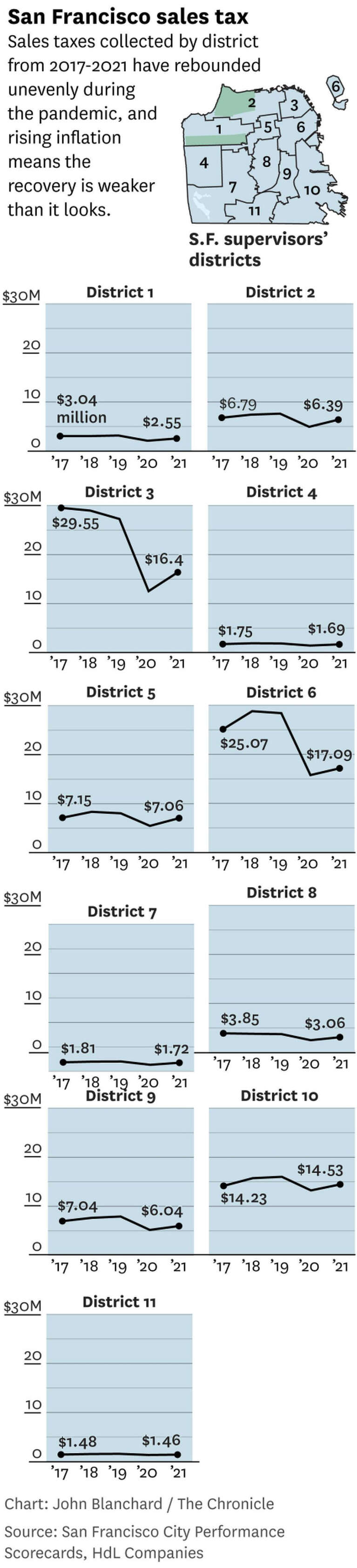

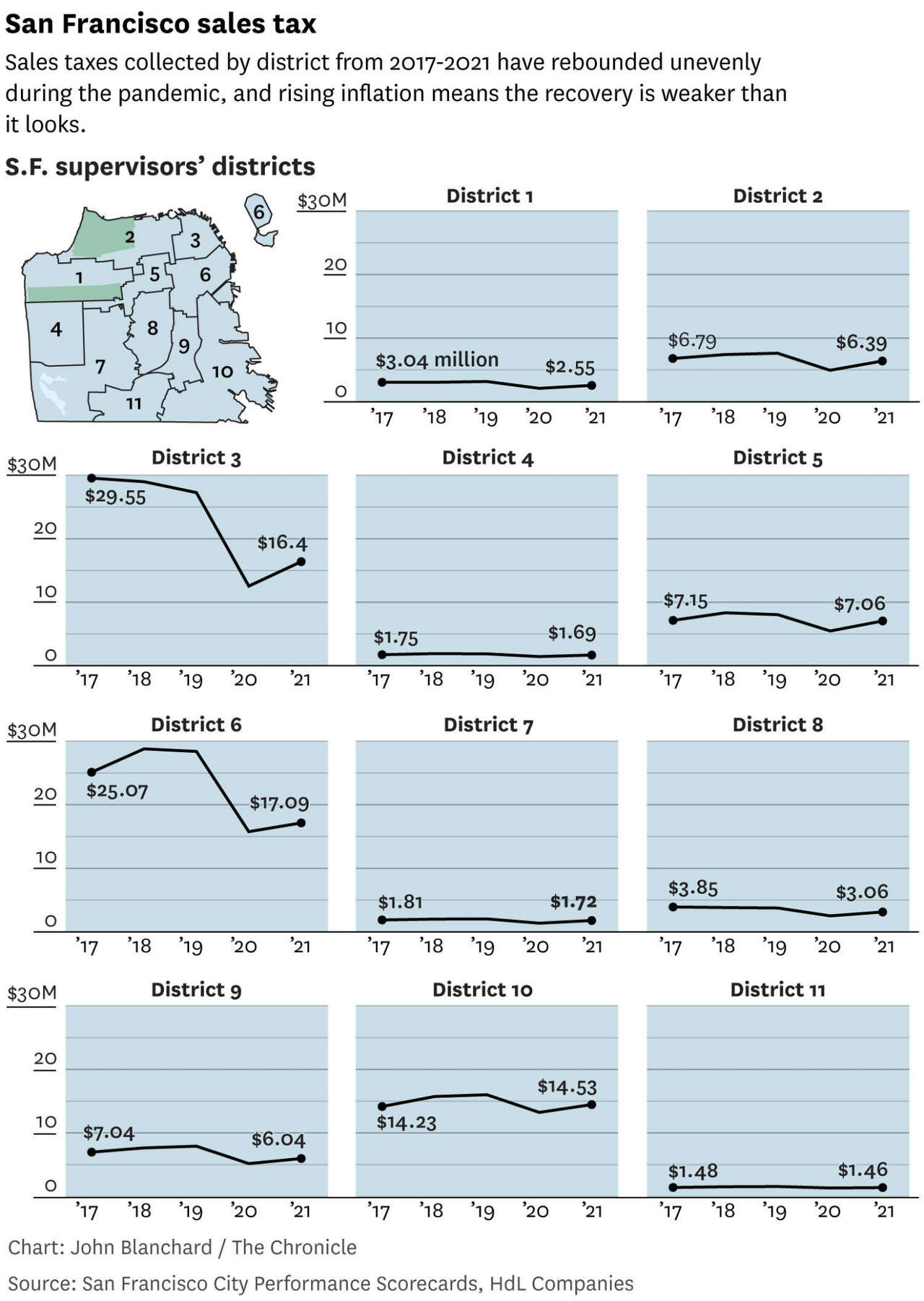

Downtown Vs Neighborhoods S F Sales Tax Data Shows Where People Are Spending Their Money

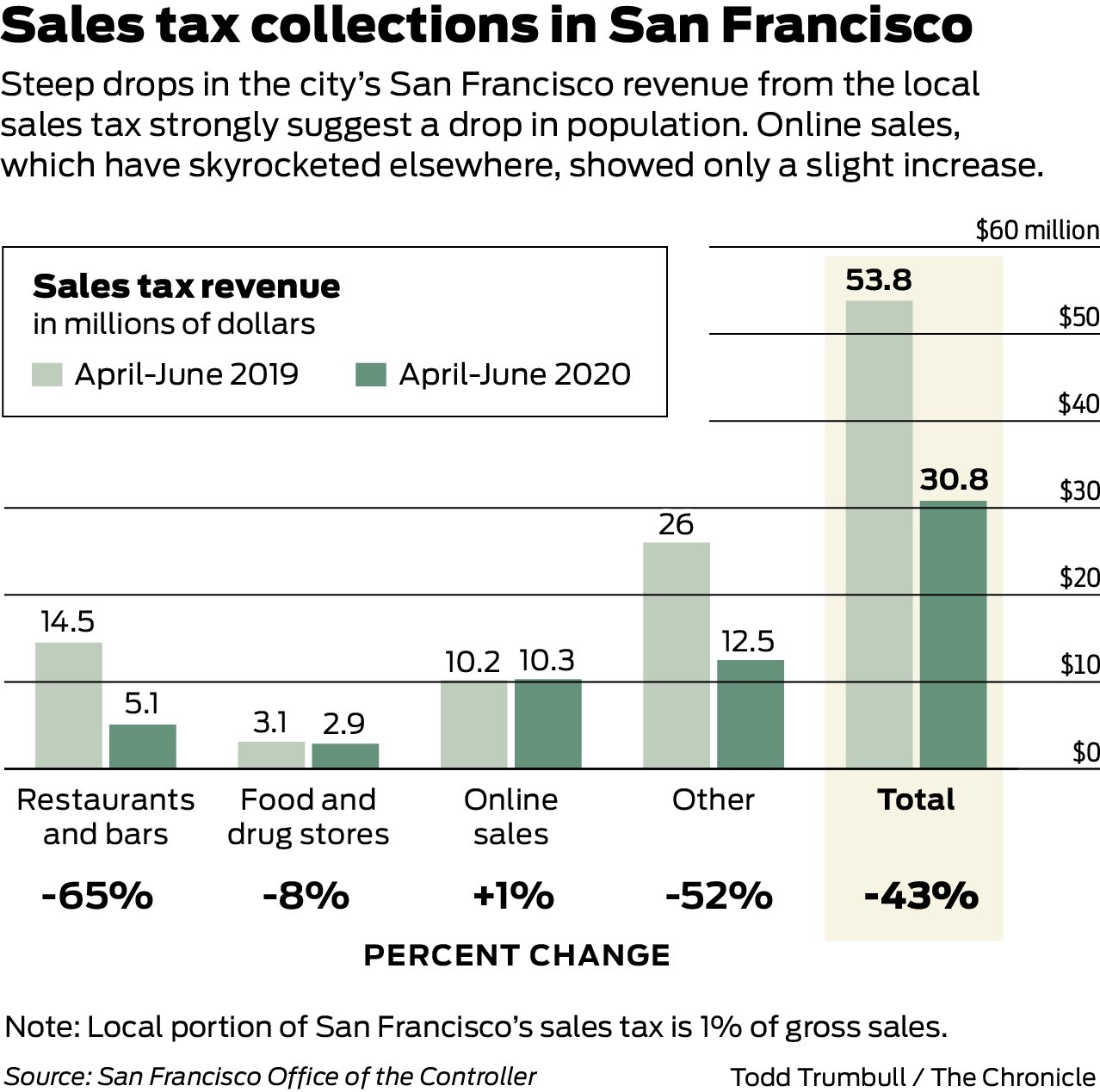

Yes People Are Leaving San Francisco After Decades Of Growth Is The City On The Decline

Downtown Vs Neighborhoods S F Sales Tax Data Shows Where People Are Spending Their Money

California City County Sales Use Tax Rates

San Francisco Prop W Transfer Tax Spur

Sales Tax Collections City Performance Scorecards

Downtown Vs Neighborhoods S F Sales Tax Data Shows Where People Are Spending Their Money

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

Understanding California S Sales Tax

An Explanation Of California S Sales Tax On Foods Bonus Flowchart La Weekly

Map Bay Area Property Taxes Kron4

Santa Barbara By The Numbers 2022 In 2022 Santa Barbara County Santa Barbara Unemployment Rate